Body Control Module Market by Functionality (High End & Low End), Component (Hardware & Software), MCU Bit Size (8 bit, 16 bit & 32 bit), Communication Protocol, Power Distribution Component, Vehicle, Electric Vehicle, and Region - Global Forecast to 2027

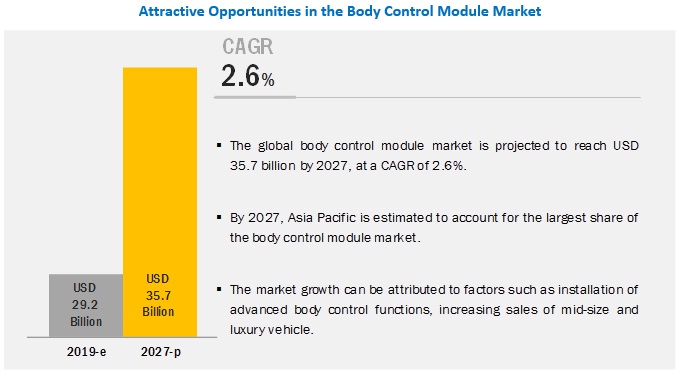

The global body control module market in terms of revenue was estimated to be worth USD 29.2 billion in 2019 and is poised to reach USD 35.7 billion by 2027, growing at a CAGR of 2.6% from 2019 to 2027. Body control module is the processor-based power distribution center that supervises and controls the function related to vehicle body like lights, windows, door locks, security, access and comfort controls. Body control module also acts as a gateway for the bus and network interfaces to interact with remote modules for other systems. Monitoring of various loads comes directly from remote ECU via CAN, LIN and Flexray communication protocols.

By Component: Hardware component is expected to be the largest segment in the body control module market

The hardware component is anticipated to be the largest market during the forecast period. Body control module market is fitted with a number of hardware components like microcontroller, printed circuit boards (PCBs), input-output devices, bus transceiver, etc. To stay ahead in the competition, Tier 1 suppliers of body control module are trying to modify the body control module as per OEM demand. They are using different combination of microcontrollers to make body control module a perfect fit for different model. Such a trend is expected to drive the market for hardware component in the future.

By Functionality: High-end BCM segment is expected to dominate the body control module market

The rising demand for concierge body functions inside the vehicle and handling such a critical function is imposing OEMs to use high-end body control module in their vehicle model variants. High-end BCM are installed with higher configuration microcontroller and other hardware component making it capable of handling complex body control functions. These features makes it preferred choice for OEM for their high-end variants of vehicle models.

By Vehicle Type: Light duty vehicle segment is estimated to be the fastest market during the forecast period

Each light-duty vehicle is installed with a body control module for proper operations of other body control functions. OEMs are customizing/tuning the body control module for their respective vehicle models. Considering the availability of customization in the vehicles, people are also willing to go for such vehicle offerings. This is the reason for the growth of the light-duty vehicle market in every region.

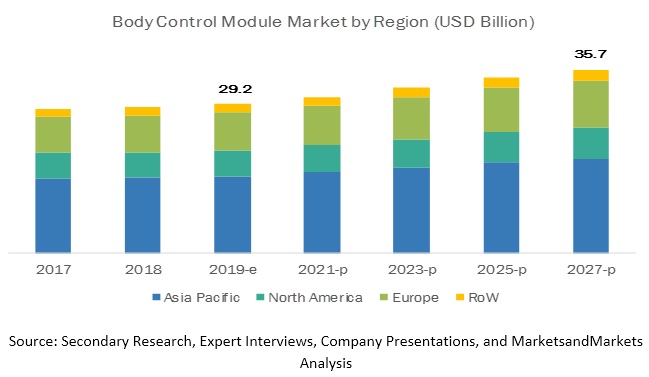

Asia Pacific is expected to account for the largest market size during the forecast period

The Asia Pacific region is estimated to be the largest market by 2027. The region comprises some of the fastest developing economies of the world such as China and India. Also, the Asia Pacific region is the largest market for automotive as the growing purchasing power of consumers has triggered the demand for automobiles in the region. Also, the increasing sales of commercial vehicles and passenger cars in the region are driving the growth of the market. Many European and North American OEMs are entering the sub-continental markets and are launching new vehicle models considering the requirement of the demographics in the region. Hence, Asia Pacific is expected to show incremental growth during the forecast period.

Key Market Players

The major body control module market players include Bosch (Germany), Continental (Germany), Lear Corporation (US), Hella (Germany), and Aptiv (UK) among others. These companies have strong distribution networks at a global level. In addition, these companies offer an extensive product range. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Functionality, Component, MCU Bit Size, Communication Protocol, Power Distribution Component, Vehicle Type, EV Type, and Region |

|

Geographies covered |

Asia Pacific, Europe, North America, and Rest of the World |

|

Companies covered |

Bosch (Germany), Continental (Germany), Lear Corporation (US), Denso Corporation(Japan), Hella (Germany), Aptiv (UK), and others |

This research report categorizes the market based on application, hardware, deployment, vehicle type, and region.

Based on functionality, the market has been segmented as follows:

- High End

- Low End

Based on the component, the market has been segmented as follows:

- Hardware

- Software

Based on MCU bit size, the market has been segmented as follows:

- 8 bit

- 16 bit

- 32 bit

Based on vehicle type, the market has been segmented as follows:

- Light-Duty Vehicle

- Heavy-Duty Vehicle

Based on the communication protocol, the market has been segmented as follows:

- CAN

- LIN

- FLexray

Based on the power distribution component, the market has been segmented as follows:

- Relays

- Fuses

Based on electric vehicle type, the market has been segmented as follows:

- BEV

- FCEV

- PHEV

Based on the region, the market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Thailand

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Russia

- Spain

- Turkey

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

RoW

- Brazil

- Iran

- Rest of RoW

Recent Developments

- In July 2019, Denso Corporation and Toyota Motor Corporation announced that they agreed to establish a joint venture for research and advanced development of next-generation, in-vehicle semiconductors. The two companies will study the details and aim to establish a new company in April 2020. Denso will hold a 51% stake and Toyota will hold 49% stake in the new company.

- In June 2019, Infineon announced an acquisition of Cypress Semiconductor. Both companies signed a definitive agreement under which Infineon will acquire Cypress for US$23.85 per share in cash. With the addition of Cypress, Infineon will consequently strengthen its focus on structural growth drivers and serve a broader range of applications. This will accelerate the company’s path of profitable growth of recent years.

- In May 2019, Management Committee of Guangzhou Nansha Economic and TechnologicalTechnical Development Zone and Denso (Guangzhou Nansha) Co., Ltd. signed an investment agreement. Denso Guangzhou Nansha will build a new 100,000-square-meter factory in the Southern part of China. The new plant will produce car electronic components such as in-vehicle computers. Denso aims at launching the operation at the new plant in 2021 and the mass production in 2022.

- In March 2019, Continental started operation of its new research and development (R&D) centre in Chongqing. The lab is focusing on the development of car body and powertrain products and automotive electronics products including solutions, in particular, the development and testing in the areas of smart keys, car body controllers, and transmission controllers.

- In October 2018, STMicroelectronics developed a new connected -car microcontroller unit (MCU) that enables secure remote updates and high-speed in-vehicle networking. Leading customers of STMicroelectronics are already using SPC58 Chorus H Line microcontrollers in the next generation of smart gateways and central body modules and are also evaluating the devices for battery-management units and ADAS safety controllers.

Critical Questions:

- How Tier I and Tier II are tuning body control module to make a best fit for customized vehicle?

- How will the implementation of safety mandates impact the overall market?

- Who is responsible for the ownership of software development for the body control module?

- What could be a possible development in communication protocols used for the body control module?

Frequently Asked Questions (FAQ):

How big is the body control module market?

The global body control module market in terms of revenue was estimated to be worth $29.2 billion in 2019 and is poised to reach $35.7 billion by 2027, growing at a CAGR of 2.6% from 2019 to 2027.

Who are the frontrunners in the body control module market, and what strategies have been adopted by them?

The global electric powertrain market is dominated by major players such as Bosch (Germany), Continental (Germany), Lear Corporation (US), Hella (Germany), and Aptiv (UK). These companies have adopted strategies such as new product developments, collaborations, and contracts & agreements to sustain their market position.

What are the upcoming trends in the body control module market?

There will be more use of high end body control module in all kind of vehicles. . High end BCM is the BCM that handles additional body control responsibility than a conventional / low end BCM. Architecture-wise high end BCM is more complex compared to low end BCM. The architecture complexity of high BCM can be seen in the figure below. High end BCM has more number of communication bus like CAN transceiver, LIN transceiver, Flexray transceiver to communicate at a faster rate with critical body functions. Critical body functions include remote keyless entry, panoramic power sunroof, and automatic trunk opener.

Which vehicle type is growing at the fast rate in the body control module market?

Light duty vehicle segment is estimated to be the fastest market. OEMs are customizing/tuning the body control module for their respective vehicle models. Considering the availability of customization in the vehicles, people are also willing to go for such vehicle offerings.

What are automotive semiconductor companies doing in this space?

In October 2018, STMicroelectronics developed a new connected -car microcontroller unit (MCU) that enables secure remote updates and high-speed in-vehicle networking. Leading customers of STMicroelectronics are already using SPC58 Chorus H Line microcontrollers in the next generation of smart gateways and central body modules and are also evaluating the devices for battery-management units and ADAS safety controllers. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Product and Market Definition

1.3 Body Control Module Market Scope

1.3.1 Years Considered for the Study

1.4 Currency Exchange Rates

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Secondary Sources

2.2.2 Key Data From Secondary Sources

2.3 Primary Data

2.3.1 Sampling Techniques & Data Collection Methods

2.3.2 Primary Participants

2.4 Body Control Module Market Size Estimation

2.4.1 Data Triangulation Approach

2.4.2 Bottom-Up Approach

2.5 Market Breakdown

2.6 Assumptions

2.7 Limitations

2.8 Risk Assessment & Ranges

3 Executive Summary (Page No. - 30)

4 Premium Insights (Page No. - 34)

4.1 Attractive Opportunities in the Body Control Module Market

4.2 Market Growth Rate, By Region

4.3 Market, By Vehicle Type

4.4 Market, By Functionality

4.5 Market, By Component

5 Body Control Module Market Overview (Page No. - 37)

5.1 Introduction

5.2 Currency & Pricing

5.3 Market Dynamics

5.3.1 Revenue Shift Driving the Body Control Market Growth

5.3.2 Drivers

5.3.2.1 Increasing Body Electronic Functions in Modern Vehicles

5.3.2.2 Cost Benefits Associated With BCM

5.3.3 Restraints

5.3.3.1 Programming of Body Control Module

5.3.4 Opportunities

5.3.4.1 Embedded Body Control Module (BCM) Solutions

5.3.4.2 Self-Driving Vehicle Can Uncover Opportunities for BCM Stakeholders

5.3.5 Challenges

5.3.5.1 Developing BCM in Line With the Increasing Complexity of Vehicle Electronics Operations

5.4 Body Control Module Market, Scenarios (2017–2027)

5.4.1 Market: Most Likely Scenario

5.4.2 Market: Optimistic Scenario

5.4.3 Market: Pessimistic Scenario

5.4.4 Impact Analysis

6 Industry Trends (Page No. - 46)

6.1 Body Control Module: Trend

6.1.1 Use of High-End Functionality Body Control Module

6.2 Regulatory Overview

6.2.1 Autosar Compliance

6.2.2 Safety Compliance

6.3 Body Control Module Market: Value Chain

6.4 Porter’s Five Forces

7 Body Control Module Market, By Functionality (Page No. - 50)

7.1 Introduction

7.1.1 Assumptions

7.1.2 Research Methodology for Functionality Segment

7.2 High-End BCM

7.2.1 Increasing Awareness Related to Vehicle Safety and Convenience is Driving the Market for High-End BCM

7.3 Low-End BCM

7.3.1 Increased Production of Economy Class Vehicles and Trucks to Drive the Market for Low-End Body Control Module

8 Body Control Module Market, By Component (Page No. - 55)

8.1 Introduction

8.1.1 Assumptions

8.1.2 Research Methodology for Component Segment

8.2 Hardware

8.2.1 Increasing Complexity of Body Control Module for Modern Vehicle to Drive the Market for Hardware Component

8.3 Software

8.3.1 Increasing Demand for Smart Body Control Module to Drive the Market for Software Component

8.4 Market Leaders

9 Body Control Module Market, By Bit Size (Page No. - 60)

9.1 Introduction

9.1.1 Assumptions

9.1.2 Research Methodology for Bit Size Segment

9.2 8 Bit

9.2.1 Increasing Demand for Economy and Mid-Sized Vehicles to Boost the Market for B Bit MCU

9.3 16 Bit

9.3.1 Increasing Number of Body Control Features to Drive the Market for 16 Bit MCU

9.4 32 Bit

9.4.1 Increasing Global Sales of Ultr-Luxury Vehicle to Drive the Market for 32 Bit MCU

9.5 Market Leaders

10 Communication Protocols (Page No. - 66)

10.1 Introduction

10.1.1 Local Interconnect Network (LIN)

10.1.2 Controller Area Network (CAN)

10.1.3 Flexray

10.2 Market Leaders

11 Power Distribution Components (Page No. - 68)

11.1 Introduction

11.1.1 Relays

11.1.2 Fuses

12 Body Control Module Market, By Vehicle Type (Page No. - 69)

12.1 Introduction

12.1.1 Assumptions

12.1.2 Research Methodology for Vehicle Segment

12.2 Light-Duty Vehicle

12.2.1 Economy Class

12.2.2 Mid-Size Class

12.2.3 Luxury Class

12.3 Heavy-Duty Vehicle

12.3.1 Truck

12.3.2 Bus

12.4 Key Industry Insights

13 Body Control Module Market, By Electric Vehicle (Page No. - 77)

13.1 Introduction

13.1.1 Assumptions

13.1.2 Research Methodology for Electric Vehicle Segment

13.2 Battery Electric Vehicle

13.3 Fuel Cell Electric Vehicle

13.4 Plug-In Hybrid Electric Vehicle

13.5 Key Industry Insights

14 Body Control Module Market, By Region (Page No. - 84)

14.1 Introduction

14.1.1 Assumptions

14.1.2 Research Methodology for Vehicle Type

14.2 Asia Pacific

14.2.1 China

14.2.1.1 Rise in Vehicle Production With Modern Body Control Functions to Drive the Chinese Market

14.2.2 India

14.2.2.1 Increasing Luxury Vehicle Sales to Drive the Indian Market

14.2.3 Japan

14.2.3.1 Significant Technology Adoption to Drive the Japanese Market

14.2.4 South Korea

14.2.4.1 Developments in Body Electronics and Reduction in Vehicle Body Weight to Drive the South Korean Market

14.2.5 Thailand

14.2.5.1 Thailand has the Largest Automotive Production Capacity Among Southeast Asian Countries

14.2.6 Rest of Asia Pacific

14.2.6.1 Increasing Sales of Premium Vehicles to Drive the Rest of Asia Pacific Market

14.3 Europe

14.3.1 Germany

14.3.1.1 Rising Adoption of Modern Technologies in Every Class of Light-Duty Vehicles to Drive the German Market

14.3.2 France

14.3.2.1 Rising Safety Concerns Among Vehicle Occupants to Drive the French Market

14.3.3 UK

14.3.3.1 Heavy Investments By Oems and Tier I and Ii Suppliers are Expected to Drive the UK Market

14.3.4 Spain

14.3.4.1 Increasing Production of D, E, and F Segment Light-Duty Vehicles to Drive the Spanish Market

14.3.5 Russia

14.3.5.1 Continuous Increase in Vehicle Sales to Drive the Russian Market

14.3.6 Turkey

14.3.6.1 Increasing Automotive Investments in Recent Years to Drive the Turkish Market

14.3.7 Rest of Europe

14.3.7.1 Continuous Growth of the Automotive Industry in Eastern Europe to Drive the Rest of Europe Market

14.4 North America

14.4.1 Canada

14.4.1.1 Increasing Use of Lcvs Equipped With Modern Electronic Architecture to Drive the Canadian Market

14.4.2 Mexico

14.4.2.1 Growth of Us-Mexico Trade to Drive the Mexican Market

14.4.3 US

14.4.3.1 Developments in the Field of Connected Cars and Nhtsa Mandates to Drive the US Market

14.5 Rest of the World (RoW)

14.5.1 Brazil

14.5.1.1 Increasing Demand for Light-Duty Vehicles to Drive the Brazilian Market

14.5.2 Iran

14.5.2.1 Increasing Sales of Luxury Vehicles to Drive the Iranian Market

14.5.3 Rest of RoW

14.5.3.1 Adoption of Modern Safety Technologies to Drive the Rest of RoW Market

14.6 Key Industry Insights

14.7 Market Leaders

15 Competitive Landscape (Page No. - 120)

15.1 Overview

15.2 Body Control Module: Market Ranking Analysis

15.3 Competitive Leadership Mapping

15.3.1 Terminology

15.3.2 Visionary Leaders

15.3.3 Innovators

15.3.4 Dynamic Differentiators

15.3.5 Emerging Companies

15.4 Winners vs Tail-Enders

15.5 Competitive Scenario

15.5.1 New Product Developments/Launches

15.5.2 Expansion, 2018–2019

15.5.3 Acquisition

15.5.4 Agreements/Partnerships/Contracts, 2017–2019

16 Company Profiles (Page No. - 128)

(Business Overview, Products Offerings, Recent Developments, SWOT Analysis & MnM View)*

16.1 Continental

16.2 Robert Bosch

16.3 Aptiv

16.4 Lear Corporation

16.5 Denso

16.6 Hella

16.7 Visteon

16.8 Infineon Technologies

16.9 NXP Semiconductors

16.10 Renesas

16.11 Stmicroelectronics

*Details on Business Overview, Products Offerings, Recent Developments, SWOT Analysis & MnM View Might Not Be Captured in Case of Unlisted Companies.

16.12 Other Key Regional Players

16.12.1 Asia Pacific

16.12.1.1 Calsonic Kansei Corporation

16.12.1.2 Mitsubishi Electric Corporation

16.12.1.3 Panasonic Corporation

16.12.1.4 Rohm Semiconductor

16.12.1.5 Toshiba Corporation

16.12.1.6 New Japan Radio

16.12.1.7 Luxshare

16.12.1.8 Omron

16.12.1.9 Diamond Electric

16.12.1.10 Embitel

16.12.2 North America

16.12.2.1 Texas Instruments

16.12.2.2 New Eagle

16.12.2.3 Maxim Integrated

16.12.2.4 Microchip Technology

17 Appendix (Page No. - 156)

17.1 Discussion Guide

17.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

17.3 Available Customizations

17.4 Related Reports

17.5 Author Details

List of Tables (156 Tables)

Table 1 Currency Exchange Rates (Wrt USD)

Table 2 Risk Assessment & Ranges

Table 3 Supply Contracts of Tier 1 Supplier With Oem

Table 4 Currency Exchange Rates (W.R.T. Per USD)

Table 5 Body Control Module Market (Most Likely), By Region, 2017–2027 (USD Million)

Table 6 Market (Optimistic), By Region, 2017–2027 (USD Million)

Table 7 Market (Pessimistic), By Region, 2017–2027 (USD Million)

Table 8 Market, By Functionality, 2017–2027 (Million Units)

Table 9 Market, By Functionality, 2017–2027 (USD Million)

Table 10 High-End BCM: Market, By Region, 2017–2027 (Thousand Units)

Table 11 High-End BCM: Market, By Region, 2017–2027 (USD Million)

Table 12 Low-End BCM: Market, By Region, 2017–2027 (Thousand Units)

Table 13 Low-End BCM: Market, By Region, 2017–2027 (USD Million)

Table 14 Body Control Module Market, By Component, 2017–2027 (USD Million)

Table 15 Hardware: Market, By Region, 2017–2027 (USD Million)

Table 16 Software: Market, By Region, 2017–2027 (USD Million)

Table 17 Recent Developments

Table 18 Market, By Bit Size, 2017–2027 (Thousand Units)

Table 19 8 Bit: Body Control Module Market, By Region, 2017–2027 (Thousand Units)

Table 20 16 Bit: Market, By Region, 2017–2027 (Thousand Units)

Table 21 32 Bit: Market, By Region, 2017–2027 (Thousand Units)

Table 22 Recent Developments

Table 23 Communication Bus Speeds

Table 24 Recent Developments

Table 25 Body Control Module Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 26 Market, By Vehicle Type, 2017–2027 (USD Million)

Table 27 Economy Class: Market, By Region, 2017–2027 (Thousand Units)

Table 28 Economy Class: Market, By Region, 2017–2027 (USD Million)

Table 29 Mid-Size Class: Market, By Region, 2017–2027 (Thousand Units)

Table 30 Mid-Size Class: Market, By Region, 2017–2027 (USD Million)

Table 31 Luxury Class: Market, By Region, 2017–2027 (Thousand Units)

Table 32 Luxury Class: Market, By Region, 2017–2027 (USD Million)

Table 33 Truck: Market, By Region, 2017–2027 (Thousand Units)

Table 34 Truck: Market, By Region, 2017–2027 (USD Million)

Table 35 Bus: Market, By Region, 2017–2027 (Thousand Units)

Table 36 Bus: Market, By Region, 2017–2027 (USD Million)

Table 37 Body Control Module Market, By Electric Vehicle Type, 2017–2030 (Thousand Units)

Table 38 Market, By Electric Vehicle Type, 2017–2030 (USD Million)

Table 39 Battery Electric Vehicle: Market, By Region, 2017–2030 (Thousand Units)

Table 40 Battery Electric Vehicle: Market, By Region, 2017–2030 (USD Million)

Table 41 Fuel Cell Electric Vehicle: Market, By Region, 2017–2030 (Thousand Units)

Table 42 Fuel Cell Electric Vehicle: Market, By Region, 2017–2030 (USD Million)

Table 43 Plug-In Hybrid Electric Vehicle: Market, By Region, 2017–2030 (Thousand Units)

Table 44 Plug-In Hybrid Electric Vehicle: Market, By Region, 2017–2030 (USD Million)

Table 45 Body Control Module Market, By Region, 2017–2027 (Million Units)

Table 46 Market, By Region, 2017–2027 (USD Million)

Table 47 Asia Pacific: Market, By Country, 2017–2027 (Thousand Units)

Table 48 Asia Pacific: Market, By Country, 2017–2027 (USD Million)

Table 49 China: Market, By Functionality, 2017–2027 (Thousand Units)

Table 50 China: Market, By Functionality, 2017–2027 (USD Million)

Table 51 China: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 52 China: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 53 India: Market, By Functionality, 2017–2027 (Thousand Units)

Table 54 India: Market, By Functionality, 2017–2027 (USD Million)

Table 55 India: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 56 India: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 57 Japan: Market, By Functionality, 2017–2027 (Thousand Units)

Table 58 Japan: Market, By Functionality, 2017–2027 (USD Million)

Table 59 Japan: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 60 Japan: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 61 South Korea: Market, By Functionality, 2017–2027 (Thousand Units)

Table 62 South Korea: Market, By Functionality, 2017–2027 (USD Million)

Table 63 South Korea: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 64 South Korea: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 65 Thailand: Market, By Functionality, 2017–2027 (Thousand Units)

Table 66 Thailand: Market, By Functionality, 2017–2027 (USD Million)

Table 67 Thailand: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 68 Thailand: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 69 Rest of Asia Pacific: Market, By Functionality, 2017–2027 (Thousand Units)

Table 70 Rest of Asia Pacific: Market, By Functionality, 2017–2027 (USD Million)

Table 71 Rest of Asia Pacific: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 72 Rest of Asia Pacific: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 73 Europe: Market, By Country, 2017–2027 (Thousand Units)

Table 74 Europe: Market, By Country, 2017–2027 (USD Million)

Table 75 Germany: Market, By Functionality, 2017–2027 (Thousand Units)

Table 76 Germany: Market, By Functionality, 2017–2027 (USD Million)

Table 77 Germany: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 78 Germany: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 79 France: Market, By Functionality, 2017–2027 (Thousand Units)

Table 80 France: Market, By Functionality, 2017–2027 (USD Million)

Table 81 France: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 82 France: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 83 UK: Market, By Functionality, 2017–2027 (Thousand Units)

Table 84 UK: Market, By Functionality, 2017–2027 (USD Million)

Table 85 UK: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 86 UK: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 87 Spain: Market, By Functionality, 2017–2027 (Thousand Units)

Table 88 Spain: Market, By Functionality, 2017–2027 (USD Million)

Table 89 Spain: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 90 Spain: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 91 Russia: Market, By Functionality, 2017–2027 (Thousand Units)

Table 92 Russia: Market, By Functionality, 2017–2027 (USD Million)

Table 93 Russia: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 94 Russia: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 95 Turkey: Body Control Module Market, By Functionality, 2017–2027 (Thousand Units)

Table 96 Turkey: Market, By Functionality, 2017–2027 (USD Million)

Table 97 Turkey: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 98 Turkey: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 99 Rest of Europe: Market, By Functionality, 2017–2027 (Thousand Units)

Table 100 Rest of Europe: Market, By Functionality, 2017–2027 (USD Million)

Table 101 Rest of Europe: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 102 Rest of Europe: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 103 North America: Market, By Country, 2017–2027 (Thousand Units)

Table 104 North America: Market, By Country, 2017–2027 (USD Million)

Table 105 Canada: Market, By Functionality, 2017–2027 (Thousand Units)

Table 106 Canada: Market, By Functionality, 2017–2027 (USD Million)

Table 107 Canada: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 108 Canada: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 109 Mexico: Market, By Functionality, 2017–2027 (Thousand Units)

Table 110 Mexico: Market, By Functionality, 2017–2027 (USD Million)

Table 111 Mexico: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 112 Mexico: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 113 US: Market, By Functionality, 2017–2027 (Thousand Units)

Table 114 US: Market, By Functionality, 2017–2027 (USD Million)

Table 115 US: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 116 US: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 117 RoW: Body Control Module Market, By Country, 2017–2027 (Thousand Units)

Table 118 RoW: Market, By Country, 2017–2027 (USD Million)

Table 119 Brazil: Market, By Functionality, 2017–2027 (Thousand Units)

Table 120 Brazil: Market, By Functionality, 2017–2027 (USD Million)

Table 121 Brazil: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 122 Brazil: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 123 Iran: Market, By Functionality, 2017–2027 (Thousand Units)

Table 124 Iran: Market, By Functionality, 2017–2027 (USD Million)

Table 125 Iran: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 126 Iran: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 127 Rest of RoW: Market, By Functionality, 2017–2027 (Thousand Units)

Table 128 Rest of RoW: Market, By Functionality, 2017–2027 (USD Million)

Table 129 Rest of RoW: Market, By Vehicle Type, 2017–2027 (Thousand Units)

Table 130 Rest of RoW: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 131 Recent Developments

Table 132 Winners vs Tail-Enders

Table 133 New Product Developments/Launches, 2015–2019

Table 134 Expansion, 2018–2019

Table 135 Acquisition, 2019

Table 136 Agreements/Partnerships/Contracts, 2017–2019

Table 137 Continental: Key Financials

Table 138 Organic Growth Strategies (New Product Developments/Expansions)

Table 139 Robert Bosch: Key Financials

Table 140 Aptiv: Key Financials

Table 141 Lear Corporation: Key Financials

Table 142 Denso: Key Financials

Table 143 Inorganic Growth Strategy (Partnerships/Collaborations/Joint Ventures/Mergers & Acquisitions)

Table 144 Hella: Key Financials

Table 145 Organic Growth Strategy (Expansion/New Product Development)

Table 146 Inorganic Growth Strategy (Partnerships/Collaborations/Joint Ventures/Mergers & Acquisitions)

Table 147 Visteon: Key Financials

Table 148 Infineon Technologies: Key Financials

Table 149 Organic Growth Strategy (Expansion/New Product Development)

Table 150 Inorganic Growth Strategy (Partnerships/Collaborations/Joint Ventures/Mergers & Acquisitions)

Table 151 NXP Semiconductors: Key Financials

Table 152 Organic Growth Strategy (Expansion/New Product Developments)

Table 153 Renesas: Key Financials

Table 154 Organic Growth Strategy (Expansion/New Product Developments)

Table 155 Stmicroelectronics: Key Financials

Table 156 Organic Growth Strategy (Expansion/New Product Developments)

List of Figures (52 Figures)

Figure 1 Body Control Module Market: Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Design Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market: Bottom-Up Approach

Figure 6 Data Triangulation

Figure 7 Market: Research Methodology –Illustration of Company BCM Revenue Estimation (2018)

Figure 8 Revenue Shift Driving the Body Control Market Growth

Figure 9 Market: Market Dynamics

Figure 10 Market, By Region, 2019–2027

Figure 11 Market, By Functionality, 2019 vs 2027

Figure 12 Integration of Various Safety Applications and Increasing Adoption of Modern Body Electronics are Expected to Boost the Growth of Market From 2019 to 2027

Figure 13 Rest of the World (RoW) is Estimated to Be the Fastest Growing Market for Body Control Module From 2019 to 2027

Figure 14 Light-Duty Vehicle is Expected to Be the Largest Segment of Market (USD Billion)

Figure 15 High-End BCM is Expected to Be the Largest Segment ofMarket (USD Billion)

Figure 16 Hardware is Expected to Be the Largest Segment in Market, 2019 vs 2027 (USD Billion)

Figure 17 Body Control Module Market: Value Chain

Figure 18 Market: Industry Concentration

Figure 19 Years Considered for the Study

Figure 20 Body Control Module: Market Dynamics

Figure 21 Automotive Electronic Content Growth

Figure 22 Automotive Embedded Software Market (2016–2025)

Figure 23 Market: Impact Analysis

Figure 24 Low-End Body Control Module Architecture

Figure 25 High-End Body Control Module Architecture

Figure 26 Market: Value Chain

Figure 27 Porter’s Five Forces: Market

Figure 28 High-End BCM is Expected to Dominate the Market, 2019 vs 2027 (USD Billion)

Figure 29 Hardware Segment is Expected to Dominate the Market, 2019 vs 2027 (USD Billion)

Figure 30 LDV Segment is Expected to Account for the Largest Market Share (USD Billion)

Figure 31 Body Control Module Market: RoW is Estimated to Grow at the Highest CAGR (2019–2027)

Figure 32 Asia Pacific: Market Snapshot

Figure 33 Europe: Market Snapshot

Figure 34 Body Control Module: Market Ranking Analysis, 2018

Figure 35 Body Control Module Manufacturers: Competitive Leadership Mapping (2018)

Figure 36 Companies Adopted New Product Development & Partnerships/Agreements/Supply Contracts/Collaborations/Joint Ventures as the Key Growth Strategy, 2017–2019

Figure 37 Continental: Company Snapshot

Figure 38 Continental: SWOT Analysis

Figure 39 Robert Bosch: Company Snapshot

Figure 40 Robert Bosch: SWOT Analysis

Figure 41 Aptiv: Company Snapshot

Figure 42 Aptiv: SWOT Analysis

Figure 43 Lear Corporation: Company Snapshot

Figure 44 Lear Corporation: SWOT Analysis

Figure 45 Denso: Company Snapshot

Figure 46 Denso: SWOT Analysis

Figure 47 Hella: Company Snapshot

Figure 48 Visteon: Company Snapshot

Figure 49 Infineon: Company Snapshot

Figure 50 NXP Semiconductors: Company Snapshot

Figure 51 Renesas: Company Snapshot

Figure 52 Stmicroelectronics: Company Snapshot

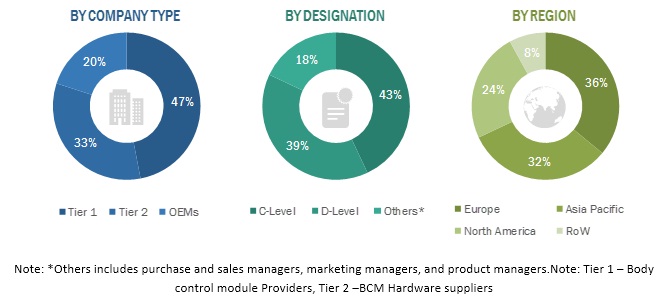

The study involved four major activities in estimating the market size for the body control module. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the body control module market size of segments and subsegments.

Secondary Research

Various secondary sources have been used in the secondary research process to identify and collect information useful for an extensive commercial study of the global market. Secondary sources include company annual reports/presentations, press releases, industry association publications, India Electronics & Semiconductor Association, ARTEMIS Industry Association, European Automotive Research Partners Association (EARPA), International Organization of Motor Vehicle Manufacturers (OICA), American Association of Motor Vehicle Administrators (AAMVA), Automotive Component Manufacturers Association of India (ACMA), China Association Of Automobile Manufacturers (CAAM), automotive magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and databases (Marklines and Factiva).

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand- and supply-side OEMs [(in terms of component supply), country-level government associations, and trade associations] and component manufacturers across four major regions-Asia Pacific, Europe, North America, and the Rest of the World. Approximately 20% and 80% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter expert’s opinions, has led us to the findings as described in the remainder of this report.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the body control module market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and body control module market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the body control module market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, segment, analyze, and forecast the market size, in terms of value (USD million), and volume (thousand/million) of the body control module market.

- To provide a detailed analysis of the numerous factors influencing the market (drivers, restraints, opportunities, and challenges).

- To define, describe, and project the market based on functionality, MCU bit size, communication protocol, components, power distribution components, vehicle, electric vehicle, and region.

- To project the market in 4 key regions, namely, Asia Pacific, Europe, North America, and the Rest of World (RoW).

- To analyze regional markets for growth trends, prospects, and their contribution to the overall market.

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for the market leaders.

- To strategically shortlist and profile key players and comprehensively analyze their respective market share and core competencies.

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the body control module market.

Available Customizations

- Detailed analysis of body control module market, Aftermarket

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Body Control Module Market